Protection or Profit? Transformative Solutions to the Home Insurance Crisis

Across the country, the chaotic and financially ruinous aftermath of climate disasters demonstrates that reliance on traditional home insurance models is unsustainable and perpetuates inequalities. Only a holistic response to this crisis, intended to ensure safe, affordable housing for all—rather than prioritizing insurance company profits—can fully address the interconnected risks communities face.

Efforts to rethink home insurance policy should prioritize comprehensive disaster risk reduction; the availability of equitable, stable and affordable insurance; and new housing in locations least at risk of disaster. CCI’s primary recommendation is that states set up Housing Resilience Agencies, new entities for housing risk reduction and insurance provision.

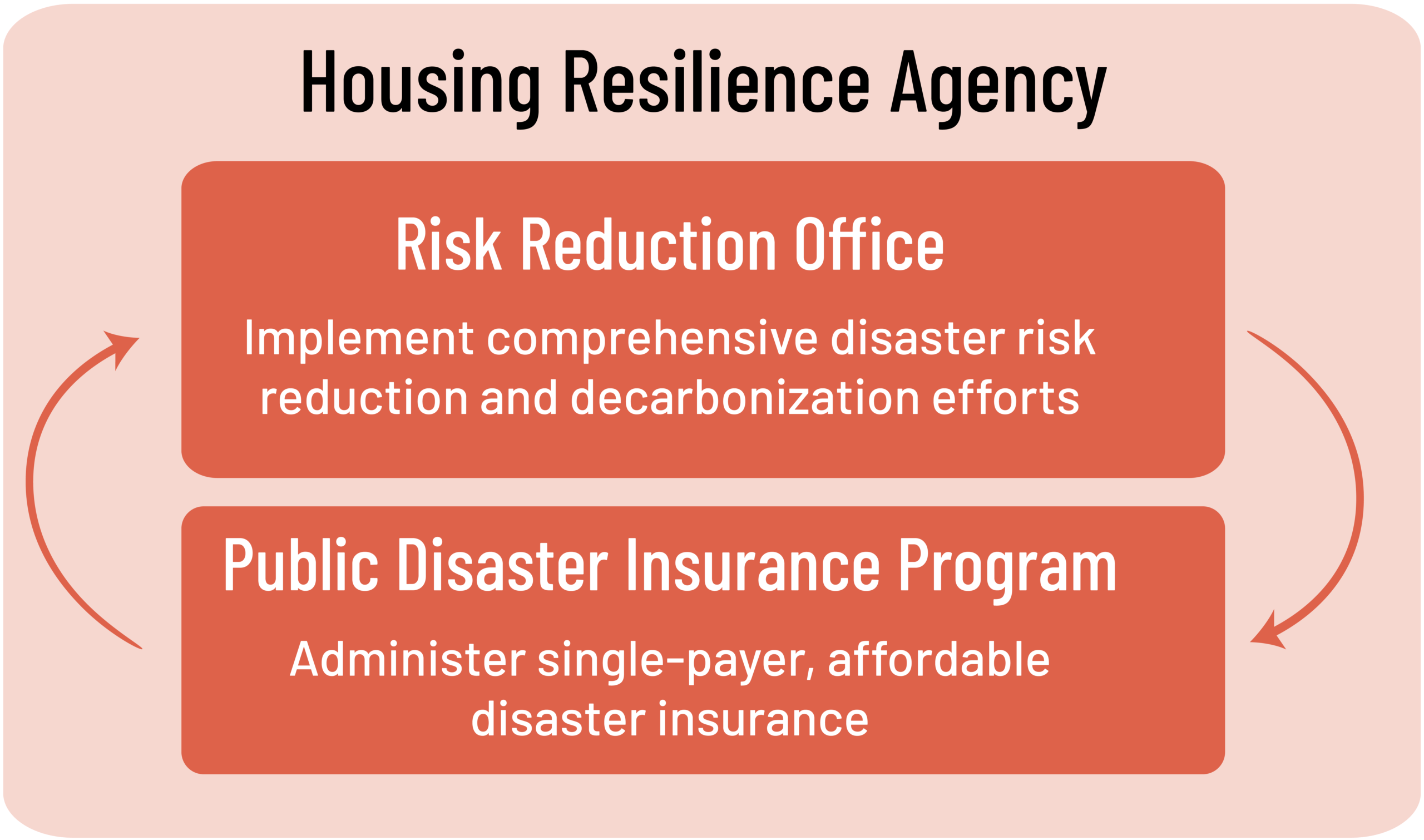

CCI’s proposal to transform home insurance involves states creating entities, termed Housing Resilience Agencies (HRAs), to run the state’s housing risk-reduction work and home disaster insurance provision with transparency, democracy, and equity.

The HRA model combines comprehensive risk mitigation with public disaster insurance provision, while also facilitating collaboration with other state entities to ensure coordinated policy that increases affordability, availability, and resilience of housing and related infrastructure.

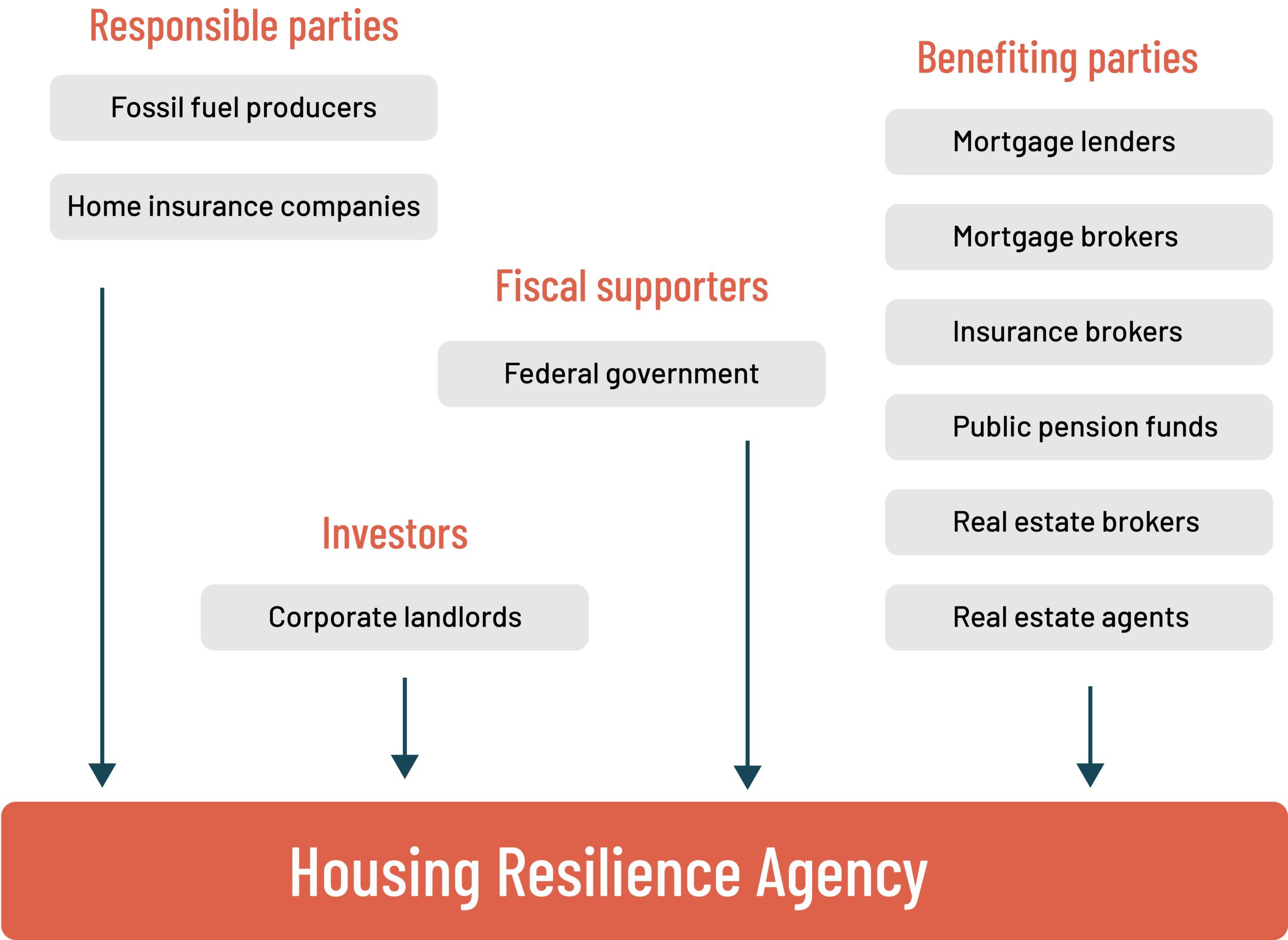

The HRA would be part of a whole-of-government effort to tackle the climate crisis. It would be funded by a variety of sources, aimed at preventing the privatization of profits and the socialization of losses that plagues current home insurance systems.

Full policy recommendations:

- States should set up Housing Resilience Agencies, new entities for housing risk reduction and insurance provision.

- States should redesign existing insurers of last resort, as detailed in our research.

- The federal government should redesign the National Flood Insurance Program into a National Disaster Insurance Program.

- The federal government should set up federal reinsurance for Housing Resilience Agencies and redesigned FAIR Plans.