Penalized: The Hidden Cost of Credit Score in Homeowners Insurance Premiums

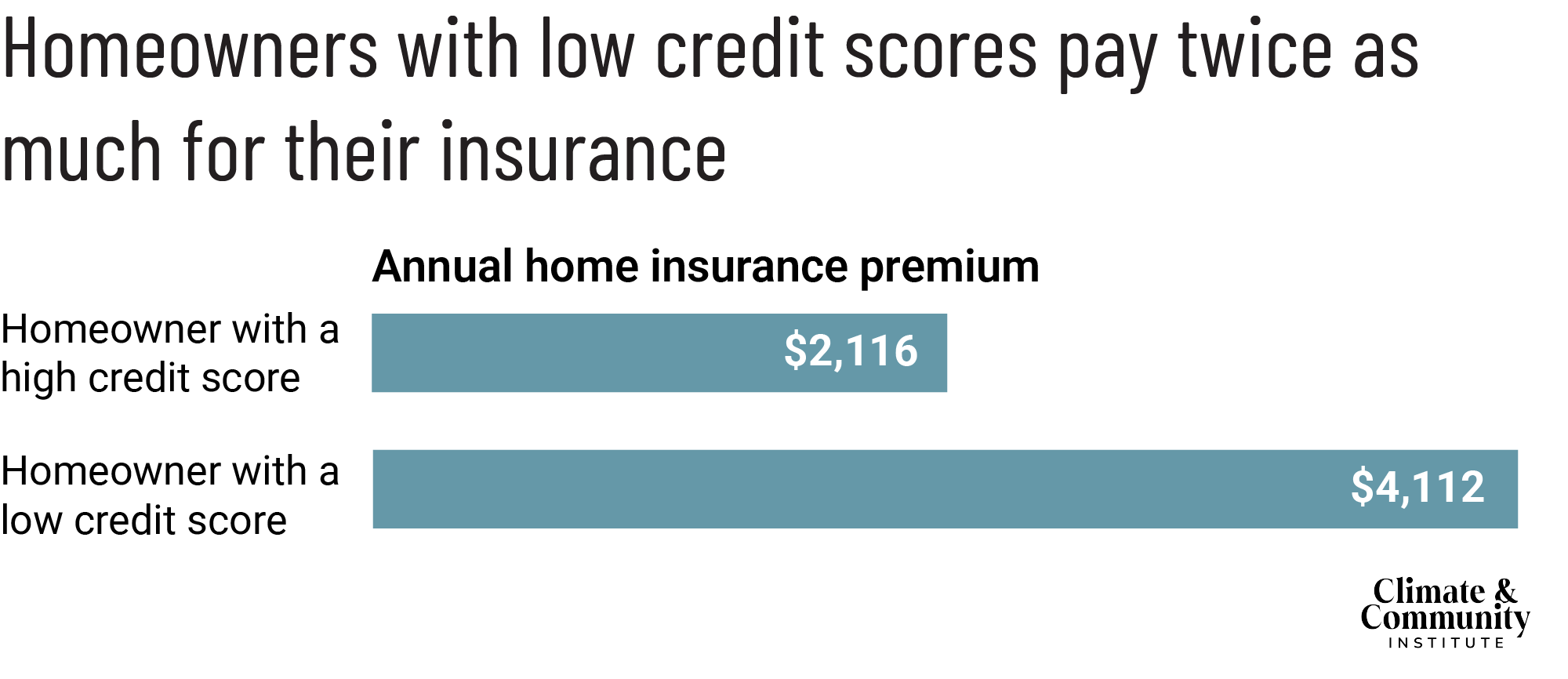

New research from Consumer Federation of America and Climate and Community Institute shows that a typical homeowner with a low credit score will pay nearly $2,000 more each year—or almost double the price—for their insurance premiums than their otherwise identical neighbor with a high credit score.

The brief, which calculates premiums for a typical homeowner across the United States, also found that it was more expensive to have a low credit score than to live in an area with high disaster risk. Average premiums for homeowners with low credit scores who live in areas with little risk of natural disasters were often higher than those for high credit score homeowners who live in high-risk communities.

The skyrocketing cost of homeowners insurance is unfairly compounded for people who maintain safe homes but have credit scores that are average or worse. The brief showed that even homeowners with medium credit scores—roughly equivalent to a 740 FICO score—pay an extra $792 per year, or 39 percent more, compared with otherwise similar customers who have high credit scores.

Insurers claim that the price of premiums provides an effective and efficient signal to people about their climate risk and the need to mitigate that risk. Our brief, however, demonstrates that insurers themselves obscure these supposed signals with the use of other—potentially discriminatory—variables in setting premium prices. According to the research, which used data purchased from Quadrant Information Services, homeowners in Pennsylvania, Arizona, Oregon, and West Virginia face the largest penalty for having a low credit score. In 23 states, homeowners with low credit—a score roughly equivalent to a 630 FICO score—pay at least twice as much as counterparts with high credit scores (roughly 820 FICO).

On average, a typical homeowner with a low credit score in the safest part of the country can expect to pay the same as an otherwise identical homeowner with a high credit score who lives in a much riskier area. This means that it is often more expensive to have a low credit score than to live in an area with a high disaster risk.

The researchers recommend that lawmakers and regulators should:

- Prohibit insurers from using credit scores and credit history in pricing homeowners insurance

- Require insurance companies to file public disclosures that provide greater transparency on their pricing models