Insurers of Last Resort: Why Today’s FAIR Plans Need a Redesign to Address the Home Insurance Crisis

As extreme weather escalates, insurance prices balloon, and insurance companies refuse to renew existing policies or write new ones, insurers of last resort increasingly provide the only property insurance coverage option for homeowners and housing providers.

This report examines the history, structure, governance, and financial exposure of every state insurer of last resort program in the United States—with deep dives into California, Florida, and New Mexico—and offers recommendations for Fair Access to Insurance Requirements (FAIR) Plan reform.

We find that:

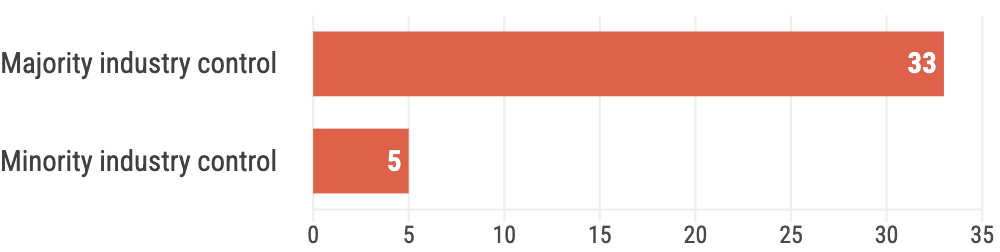

- FAIR Plans are state-enabled, but are run by and for private insurance companies: at least 86 percent of FAIR and Beach/Wind Plans, insurance industry representatives control the majority of governing board seats. FAIR Plans are created through state legislative action and enabling statutes, and are given the power to do things private insurance companies couldn’t otherwise do, but state insurers of last resort in nearly every instance are more properly considered private insurance plans.

Industry control in plan boards

- The last resort model is not optimal insurance design. While insurer of last resort programs provide a safety net for policyholders in states where such programs exist, the escalating number of extreme weather events, fueled by the climate crisis, is driving growth and strain in some programs, further exposing the limitations of the insurer of last resort model. By law, most insurers of last resort have requirements to avoid competition with the private market. By pushing the least-risky policyholders back onto the private market, this model concentrates risk rather than spreading and pooling across different types, levels, and geographies of risk. It also includes little to no effort at risk reduction, a key preventative aspect of good insurance policy design.

We recommend that FAIR Plans be improved to achieve the objectives of accessible and affordable insurance, and to better address the climate crisis:

- Restructure financial models to orient toward clear-eyed risk assessment, prudent use of Plan resources, and funding structures that better reflect the drivers and beneficiaries of stable property insurance markets.

- Offer robust policies at affordable rates by expanding coverage beyond the bare bones, broadening coverage offerings, and ensuring affordability of premium rates.

- Require private market participants to bear more risk by prohibiting private insurers from recouping FAIR plan costs and establishing robust coverage requirements for private insurers.

- Establish transparent, democratic governance by limiting the private insurance industry’s role in FAIR Plan governance, establishing democratic accountability, and requiring transparency in plan administration.

- Engage in comprehensive, proactive hazard mitigation by developing internal understandings of current and future risk from extreme weather, investing in hazard mitigation, and prioritizing proactive community-level risk reduction.

- Coordinate insurance, housing, land use, and disaster response policymaking by actively collaborating with other state-level entities.