Financial Distress in the Multifamily Rental Market, and What It Means for Tenants

Financial distress in the multifamily market is on the rise in the United States, with loan delinquencies nearly doubling in the last year alone and recently reaching their highest rate in the last 10 years. Real estate industry experts have highlighted a confluence of factors driving escalating worries of widespread financial distress, and tenants—who do not have a say over what level of financial risk their landlord takes on—are bearing the brunt of growing financial distress.

This brief explains what financial distress in the real estate market is, the core drivers and impacts of multifamily financial distress, and argues that the multifamily rental housing market should be a focus of research, policy, and advocacy in the coming years.

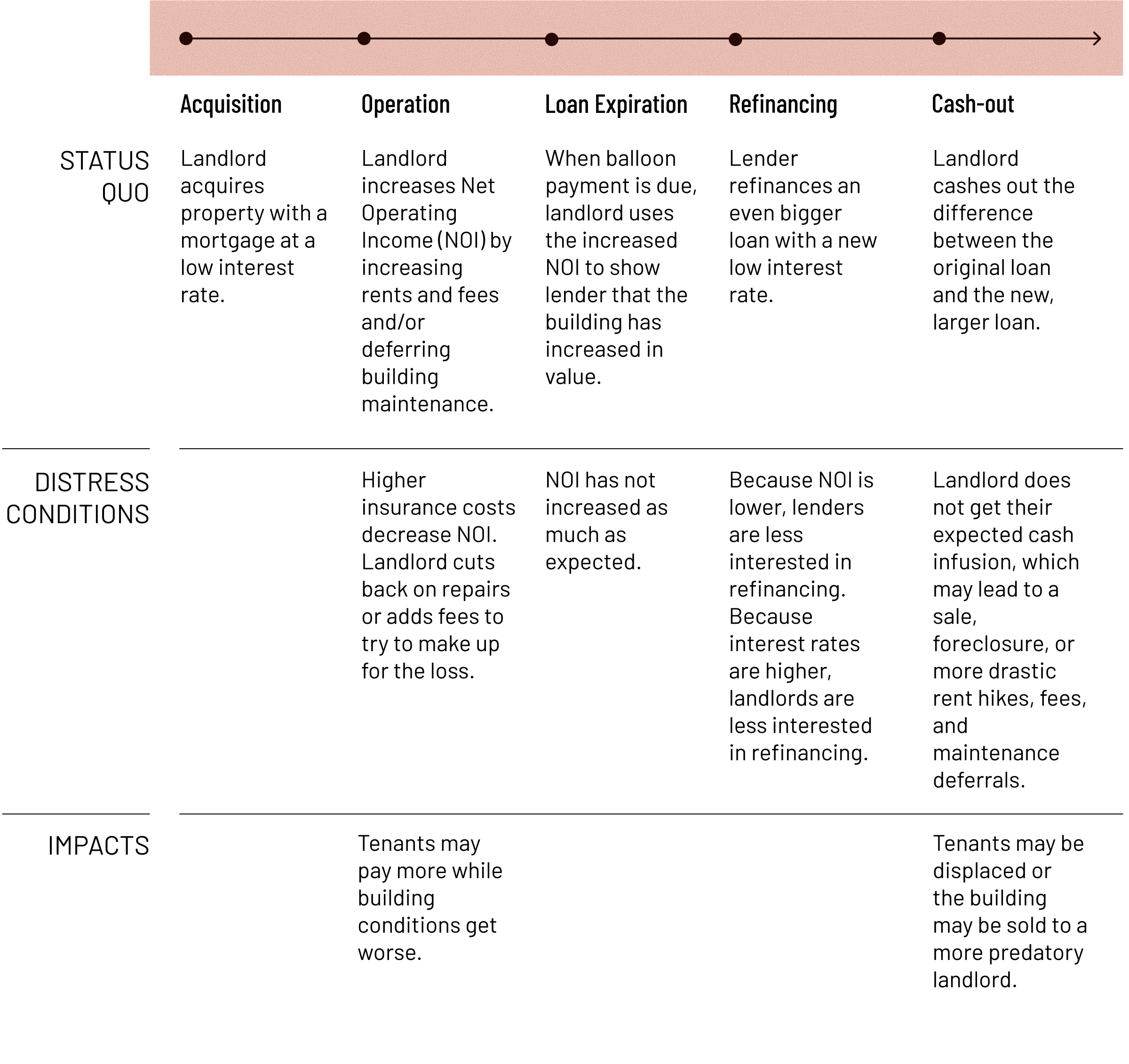

Status quo versus distress conditions in the multifamily market

In this brief we find that:

- Financial distress is an all-too-common feature of the United States financialized housing system. Understanding the underlying drivers of profit in the rental market is essential for making sense of rising financial distress, in particular the relationship between cash flows and property values as a mechanism for profit over the last few decades, and why fast rising rents and deteriorating building conditions have become so prevalent.

- There are four main drivers of financial distress in the multifamily market unfolding concurrently: (1) a changing financing and monetary landscape, (2) changes in operating income and expenses, (3) political instability, and (4) a rapidly worsening climate crisis.

- Landlords are responding to financial distress through a variety of mechanisms, including the “extend and pretend” approach (in which landlords and lenders reach agreements to delay loan refinancing or specific payments until financial conditions appear more favorable), increasing net operating income by raising rents and fees or cutting back on expenses; and lobbying for changes to policies that restore the status quo.

- Without intervention, tenants could bear the brunt of financial distress through deferred maintenance, rent hikes and fees, and further market consolidation. Contemporary housing policy, research, and organizing should take seriously the role of financial distress and craft solutions to both limit distress and ensure tenants do not shoulder the burden when and where it does occur.